Mastering art of money through budgeting

Professors discuss personal experience with finances, strategies for financial success

January 30, 2020

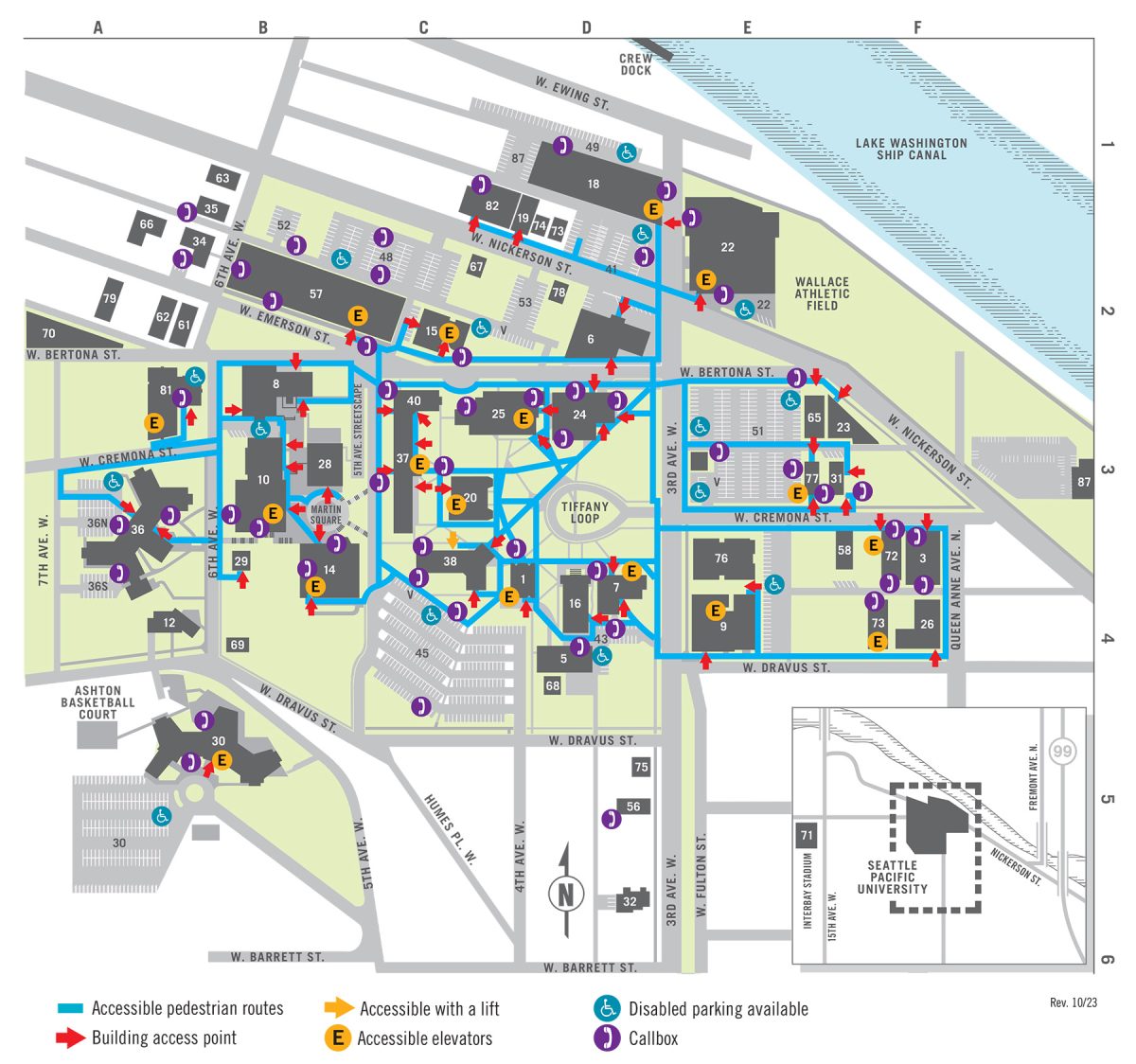

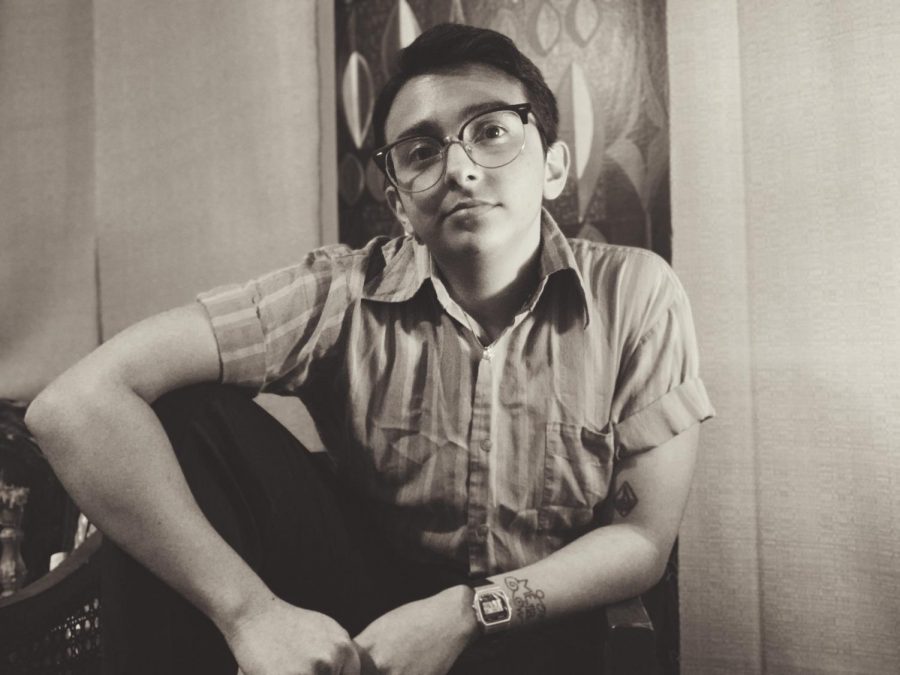

Jack Parisi, a junior studying business marketing, is buying in bulk to stretch his food funds at Cash & Carry.

A college student checks their bank account balance on their phone to find that there are only a few dollars left. They stand there panicking, not knowing how they are going to pay for their food, tuition, and a stack high of other bills. While a stereotype of college students, this remains an unfortunate reality.

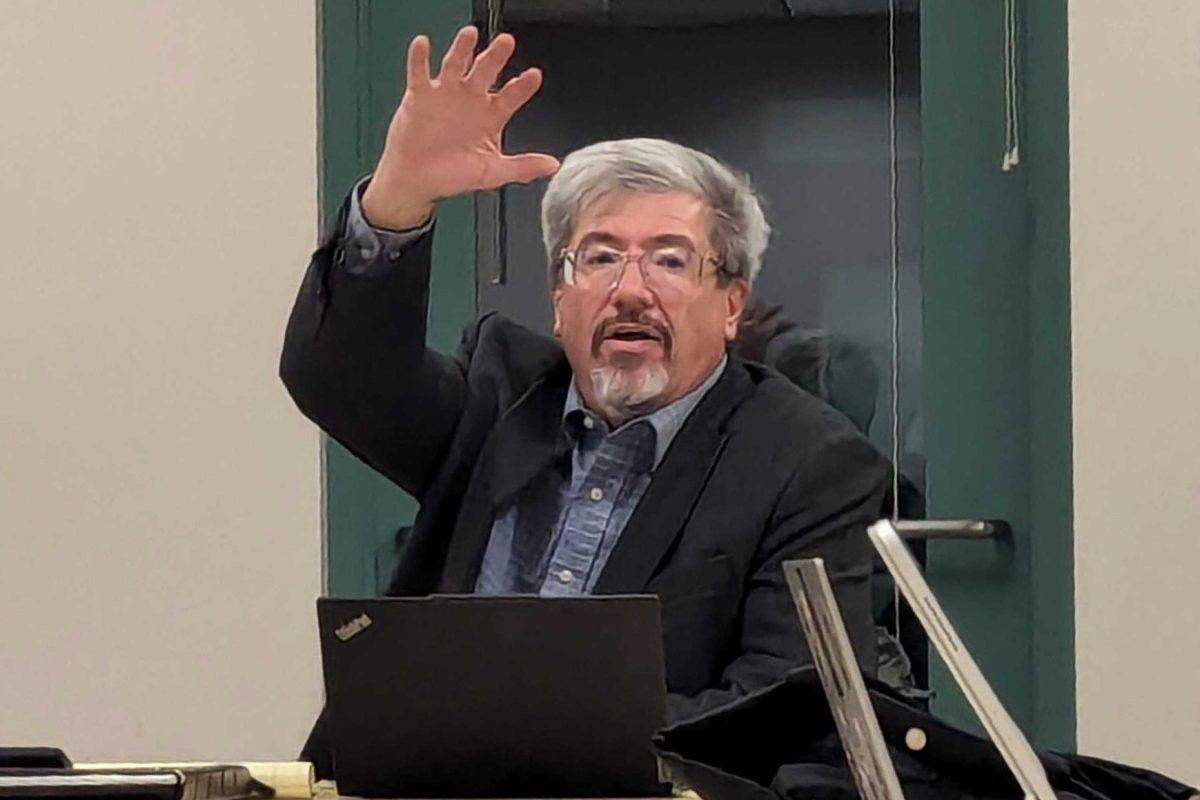

This is an experience that professors in the School of Business, Government and Economics Randy Beavers and Charlotte Qu can relate to even though they are no longer in college. Through living the painful reality of college and living on a limited budget, they learned how to deal with the stress of managing finances.

Beavers recalled his freshman year when he did not work and had to make his savings last until he got a job later in college.

“My freshman year I did not work but it was extremely stressful because I only had … less than a thousand dollars in a bank account … after I paid for books, it was pretty much like we could get a once a week splurge,” Beavers said.

“As I kind of progressed through college I did start working more and more. Some of it was for money and other parts of it were for enjoyment.”

Qu had a similar experience once she moved to the United States from China for graduate school.

When she got to the U.S., it seemed like everything was double the price due to the difference in value between the Chinese yuan and the U.S. dollar.

She described one of her most terrifying financial moments was when one of her roommates had to move out of their apartment, leaving her and her other roommates to scramble to pay the bill until the friend later reimbursed them.

Afterward, she learned that it was necessary to spend less and look for ways to cut costs in order to save money.

“You look for free food on campus and free events,” Qu said. “Cooking by yourself saves so much more money than eating out.”

Like Qu, Beavers had to learn about budgeting through anxiety-inducing avenues.

Beavers was raised in a Christian family which, he said, ingrained in him the importance of saving and being content with what he was given. He also watched how financial struggles had forced his parents to live paycheck to paycheck. Dr. Beavers also experienced travesty when he lost everything he had when the Tuscaloosa, Alabama tornado hit in 2011 and destroyed everything he had.

“I’m not going to spend more than I have because I’ve seen what happens when you do,” Beavers said.

Because of their backgrounds, both Qu and Beavers have strategies for dealing with limited financing.

“Just being patient and focusing on the long term. It is kind of hard sometimes to have that perspective when it’s like ‘man I haven’t gotten to go to a movie or go do anything fun in a while,’” Beavers said.

Qu also suggested that students find lower cost alternatives to expensive items. For example, buying used furniture or investing in a Keurig instead of daily Starbucks runs.

While, in the moment, budgeting may seem disappointing, it can also make someone feel happier by making them focus on what they really need to consume, according to Qu.

“It feels good to just spend and forget about the number, but it also feels good when you are planning and then being smart and more conscious about what you really need,” Qu said.

Both Qu and Beavers also had advice for students when it came to creating a model for budgeting.

Beavers described zero based budgeting, which divides money into specific spending categories even if someone does not know what it will be spent on.

“Basically, see what you spend your money on and every dollar, even if you don’t necessarily know when you start off with where it will go, you assign it somewhere,” Beavers said.

Qu suggested a similar method that involves comparing the cost of something to the actual happiness it brings.

“You could draw a chart of the amount of utility something brings you and then the cost and then look at both and decide the areas where you can cut back the most,” Qu said.

She also said that having a savings account separate from the account one uses to make purchases can help.

“You can create a savings account and send the $50 to that savings account at the beginning of the month and then live on the rest … Assume you don’t have it.”

Most importantly, when dealing with personal finances students should consider what brings them happiness. Then, they should leave room in their budget for what they enjoy, even if they can only afford to do it in moderation.

“You want to balance your utility versus the amount of savings,” Qu said. “You don’t want to kind of abuse yourself, so if someone just really likes eating out and not eating out causes a lot of misery on that person, I wouldn’t advise a person to never eat out.”

For students looking to understand their finances better they can take Beaver’s section of BUS 3950: Spirituality and Business, which focuses on faith and finances and covers topics like debts, budgeting and retirement issues each quarter. Students can also take FCS 3410: Personal Finance and BUS 3250: Business Finance. Students can also visit cashcourse.org for assistance.