Panel discusses economic impact

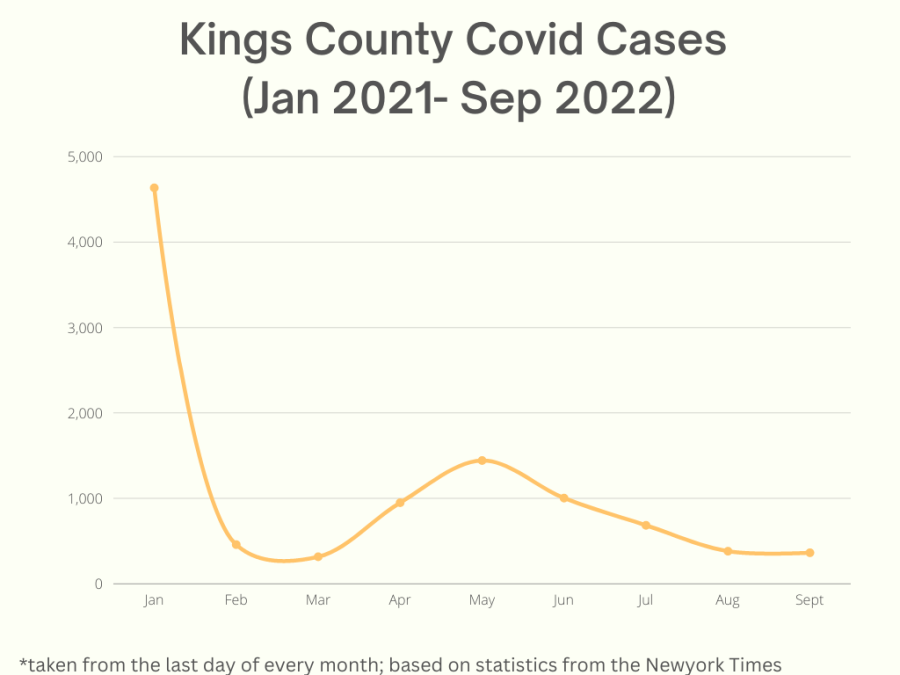

According to Forbes, as of February, the student loan debt sits at $1.3 trillion with 44.2 million borrowers.

From the class of 2015, New Hampshire has the highest average loan per student at $36,101 and Utah has the lowest at $18,873. Within this range, Washington’s average is at $24,600.

Student debt is a nationwide problem, a problem Caroline Metsker recognizes and wants to address.

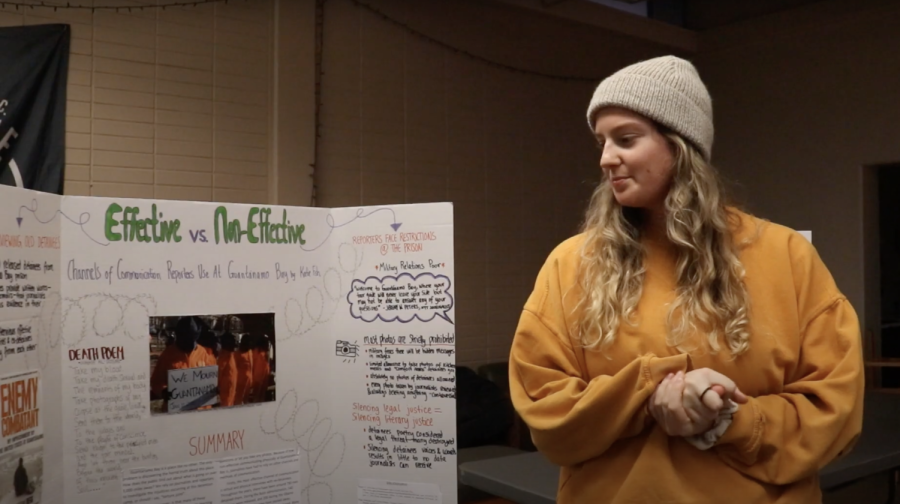

Metsker is a senior journalism student with a minor in political science. She also serves as the executive council chairwoman for American Enterprise Institute (AEI), a think tank in Washington, D.C. that promotes the competition of ideas on college campuses through their Executive Council program, allowing students to hold events on public policy issued to create campus discussions.

The Executive Council at SPU has decided to tackle student debt, acknowledging that it is an issue applicable to many students who attend an expensive private school.

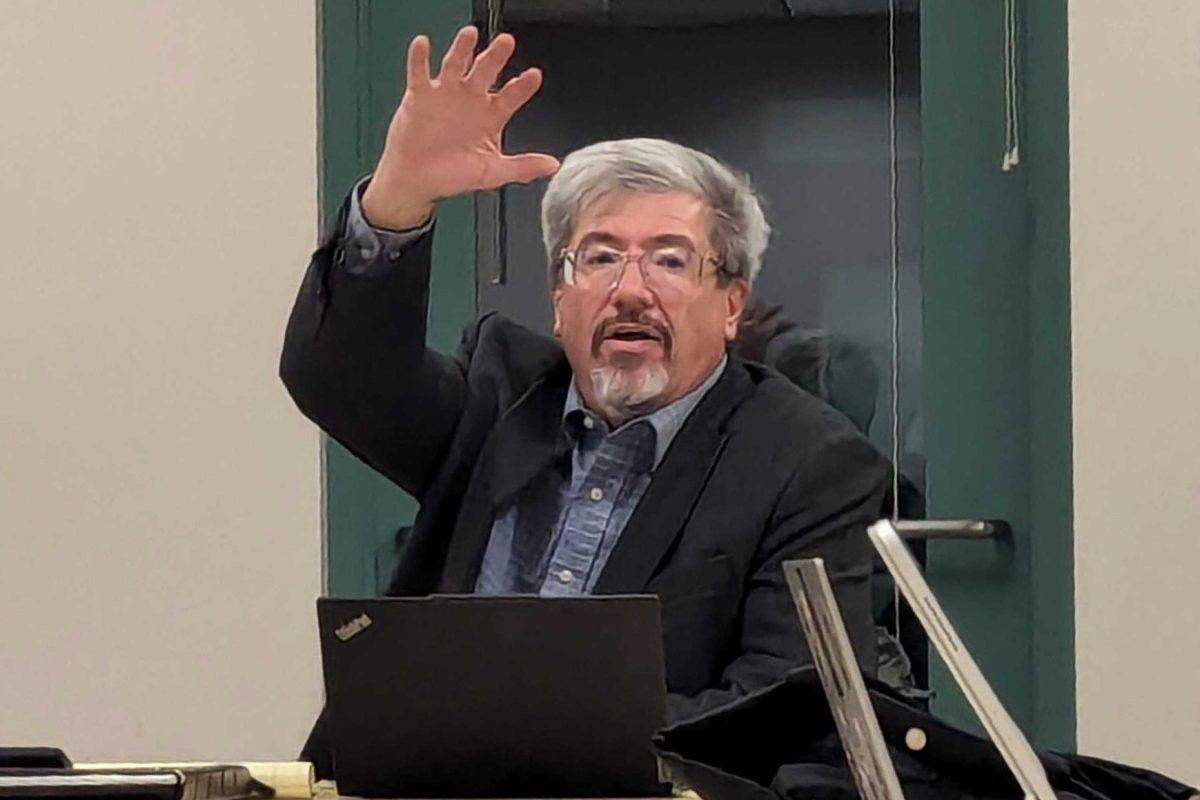

On Tuesday, Nov. 7, SPU’s AEI hosted an event in Demaray 150 titled “Got Debt?” which began at 7 p.m. The event featured a documentary showing of “Broke, Busted, & Disgusted,” followed by a panel discussion featuring Associate Professor of Economics Geri Mason, Associate Professor of Political Science Caleb Henry and Nate Mouttet from the Office of Enrollment Management and Marketing.

Serving as moderator for the event, Kek Biel, a political science student, collaborated with Metsker, coming up with questions to ask the panelists. His concern about student debt revolved around the increased costs of education and the “limited resources or ‘pools’ of opportunity that students who incur the debt face.”

“As for myself, this experience was much rockier than it should have been. My second go-around definitely has been different, and I wish I would’ve had a concrete plan,” he explained.

Thanks to an academic scholarship and working part-time, Anastasia Kharitonova, a journalism and political science student, has said she has been “extremely blessed” not to have student debt from her undergraduate experience.

She hopes to address the student debt crisis indirectly by pursuing a career that will help immigrants, particularly those who are undocumented or coming to the United States in their teenage or young adult years.

“Unfortunately, they are often excluded from many benefits like state aid and scholarships that require citizenship,” Kharitonova explained. “Navigating financial aid for immigrants is also often complicated by an unfamiliarity with U.S. college systems, language learning curves, and more. I would like to give hope to these young people that pursuing an education is worth it and financially possible.”

In many ways, student debt dampens what should largely be a positive university experience, she added. She has seen “pervasive resignation, frustration and fatalism” among many of her fellow students who will be paying off their debt well into their post-college careers.

To do this, Kharitonova plans on attending graduate school, potentially needing to take out loans herself. So, she wants to learn how to build a smart financial plan, and the first step in doing so is to learn about and understand the crises on a national level.

Mouttet is the youngest of six kids, but the oldest three siblings either were not able to attend or did not finish college.

When the fourth child of the family attended college, things changed. The younger three children earned their degrees and moved on to obtain professional jobs.

To achieve this, Mouttet had to work through college, waiting tables and doing farm work in the summer.

By the time his final year came around, his family had run out of money and he had to take on loans. By his sixth year of being in the workplace, he had sold his car and walked to work.

He realized that he wants to be able to compellingly tell students, “It may be worth it to go to college, but you have to count the cost. You have to know what you’re taking on as a student.”

College tuition has been on the rise for decades and will only continue to go up. Currently, SPU’s tuition sits at $40,464 without room and board and other fees. Consequently, many of SPU’s students have had to take out loans to pay for school.

Nationally, as more and more students take out more loans, the economy is impacted in many negative ways, Kharitonova said. Those straddled with debt are less likely to make long-term investments and save for other things life such as retirement, home purchases, etc.

Mason remembered, in an exercise asking her students to share one fun fact about themselves, she had one girl share that she liked reading the terms and conditions of things, and Mason explained that knowing is a step toward tackling student debt.

“The bottom line is, when you sign that dotted line, it’s binding whether you understood what you were signing or not,” she said. “The one thing I would tell everybody before they walk in the financial aid office or go on that website is to read everything first.”

This being said, it is important to not place the blame of student debt on one source, added Kharitonova. There are many forces that go into the problem, and students themselves are not immune from the responsibility of their financial situations.

While cuts in government funding is certainly a contributing factor, Henry added that one of the reasons for increasing costs, especially at a private institution, are the increased services that universities provide.

“The universities have found ways to bring students who normally would not have been able or would not have college, allowed them and have given them the opportunities to get there, but that also comes at a cost,” he said. “The university provides many more services to the students than they did 30 years ago, but it’s also more expensive.”

Because of the increasing number of universities and institutions of higher education, universities are competing more. While competition drives innovation in any market, this competition in higher education focuses on nonacademic factors.

“The research shows that only the students who are the top 5 or 10 percent of the SAT scores are actually making their academic decisions on the academics of the institutions,” she said. “The other 90 percent of students are choosing based on amenities.”

Leaving the event, Metsker hopes that students will at least be able to see the scale of the debt problem.

“When students are aware of this issue in our country and are actively learning the tools they can use to make a difference in the world, I think there’s a good chance that we, as students, can take steps to find solutions to this problem,” she said.

Apply for scholarships, Mason encouraged. Instead of applying for the big amount scholarships, apply for several obscure ones with smaller amounts.

While it may be more work, it is worth it in the long run, she said, citing one of her students who received $15,000 in scholarships thanks to the extra work.

“There are solutions, and they’re not necessarily easy or quick, but they’re better than just accepting a terrible situation,” Kharitonova said. “If we’re going to create working solutions, they need to be multifaceted.”