Penny pinchers

Students fight Seattle’s high prices with their own saving strategies

November 5, 2021

Broke and hungry, the average college student is a perfect archetype for cheap spending. Whether it is earning a discount on a drink or finding entertainment without a price tag, affordability is a priority for students across the country.

Unfortunately, not every school is situated within a college-friendly economy, and Seattle is one of the most expensive cities in the United States to live in.

In 2021, the Center for Regional Economic Competitiveness compared the price of 60 different products across 275 cities. Only three things are cheaper in Seattle than anywhere else: mortgage rates, margarine and milk.

For the high prices of local entertainment, academics and transportation, students at Seattle Pacific University are inclined to think smart about spending and find ways to save cash.

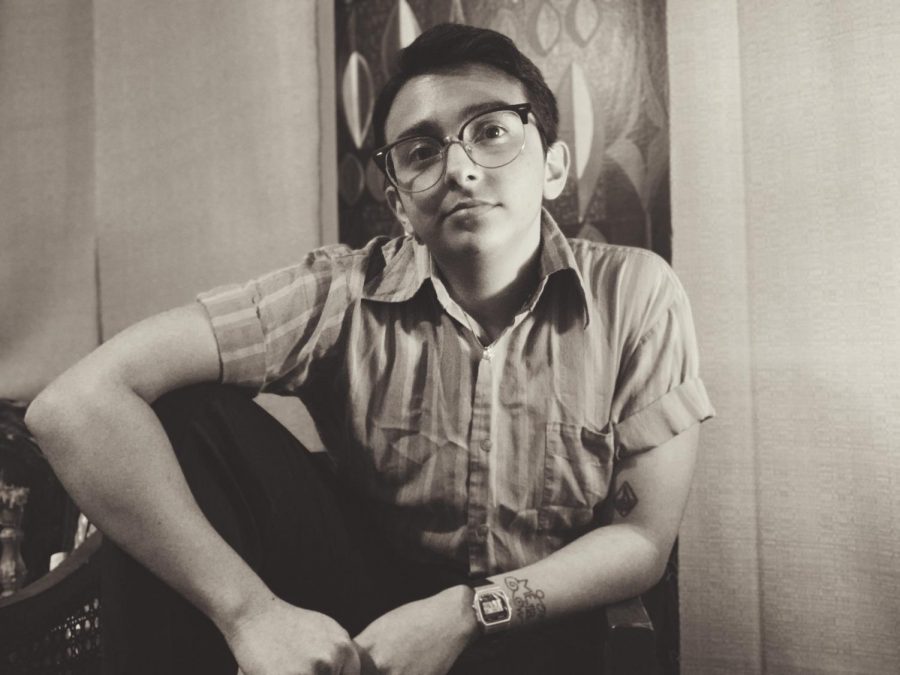

Sophomore biology major Jewel Garcia noticed stark differences in Seattle prices compared to her home in Hawaii.

“I’ve been in Seattle for a month and a half, and from where I am, the first thing that stuck out to me was the sales tax. Ten percent is a lot from where I come from,” said Garcia. “You have to know how to self discipline yourself when it comes to things that aren’t covered by your tuition or room and board.”

Washington has the fourth highest sales tax in the United States, a non-negotiable for everyone in Washington regardless of income. For students with cars, Washington also has the third highest gas tax in the nation as well.

Junior business and philosophy major Adam Karlek agreed that essentials often appear the most costly, but there are strategic ways to save.

“Gas prices in the city? Far more expensive. Food prices in the city? Far more expensive. But find someone with a Costco membership or get the student membership for thirty bucks. It’s way cheaper on gas,” said Karlek.

More than the cost of living, there is also the cost of fun. Fortunately, SPU is now in-person and frequently hosts complimentary treats for students.

Garcia notes that ‘free’ still requires a little looking around.

“They have a lot of food events [on campus],” said Garcia. “Keep your eyes open for the posters. You can snag a cinnamon roll or a donut every Wednesday morning at the Center for Career and Calling.”

For those seeking to save money outside of SPU, it cannot hurt to ask local businesses or restaurants if they offer student discounts.

Senior psychology and Christian reconciliation major, Devon Yamane, expressed how her campus-friendly attire landed her an unexpected deal.

“I just learned that Two Kick coffee shop has a student discount. I was wearing an SPU sweatshirt one day and they noticed and gave me a discount,” said Yamane.

Spending is a habit shaped by many lifestyle choices and day-to-day decisions. Part of the responsibility entails various means of discipline and practice. Oftentimes, the small choices add up for better or for worse.

Karlek chooses to budget all of his various expenses such as gas, food and entertainment. There is a certain sense of security when financial decisions, big or small, can be made on sound judgement.

“I think the benefits of budgeting is that you’re not overspending, and you’re making a plan for how you’re gonna use future money and what life is going to look like ahead of you,” said Karlek.

For Garcia, budgeting is a communal effort. A little help from her friends keeps Garcia responsible for her own spending.

“Thankfully, I am surrounded by people who can budget their money, so it’s good to have friends around you who can keep you in check,” said Garcia.

While budgeting incentivizes people to spend less, it also pushes people to give more. Setting aside money for generous and community-oriented values is an investment of character.

Yamane’s regular tithes to the church is a practice of financial discipline that contributes to her spiritual principles.

“Think about how your decisions impact you on a greater scheme. If you go to a church, I’d encourage you to maybe look into tithing,” said Yamane. “It has really changed the way I view my financial life and history, so tithe at a church. It’s really good for you and gets you closer to God by thanking him for the various ways that he’s blessed you.”

To say Seattle is cheap is to say college students are rich. But in their resourcefulness and desperation, students prove that beggars can be choosers if their money is managed well. No one is alone in trying to survive.

“Be in community with people, because we need mirrors in our lives,” said Garcia.