Invest now

How the average student can invest in their future by participating in the stock market

February 12, 2021

Gamestop was a rollercoaster.

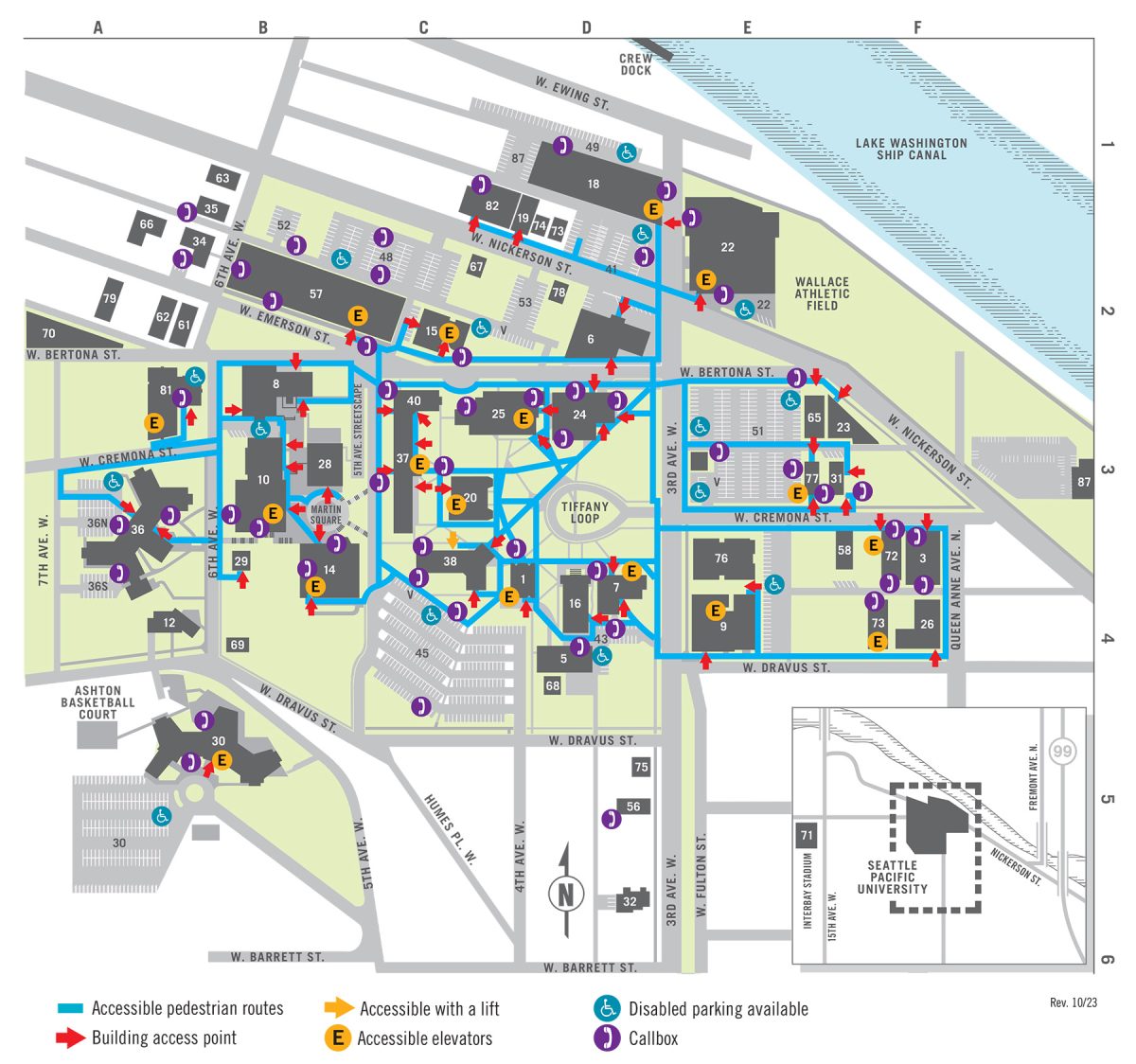

Riding the hype of national television and social media, shares of the video game retailer’s stock skyrocketed from about $20 to a peak of $483 in a matter of two weeks. With so much attention surrounding the events, it displayed the accessibility for anyone to participate in the stock market. At Seattle Pacific University, students consider and reflect on the importance of investing in the stock market today.

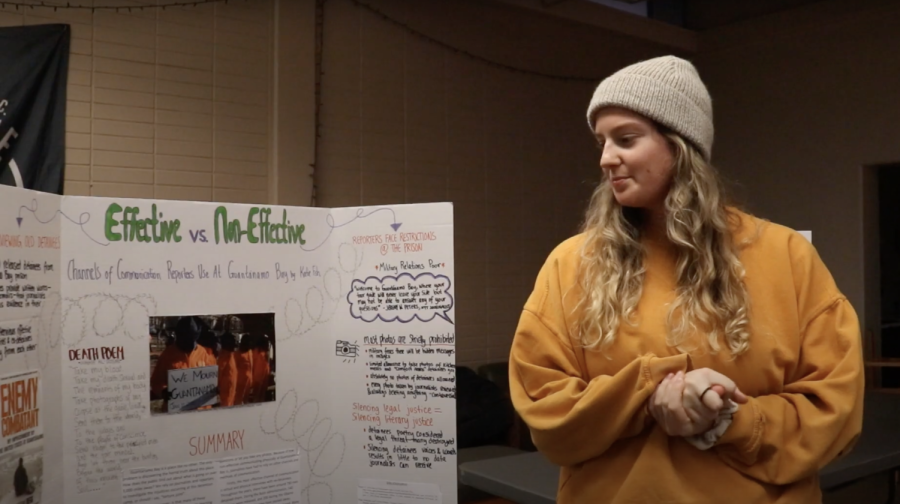

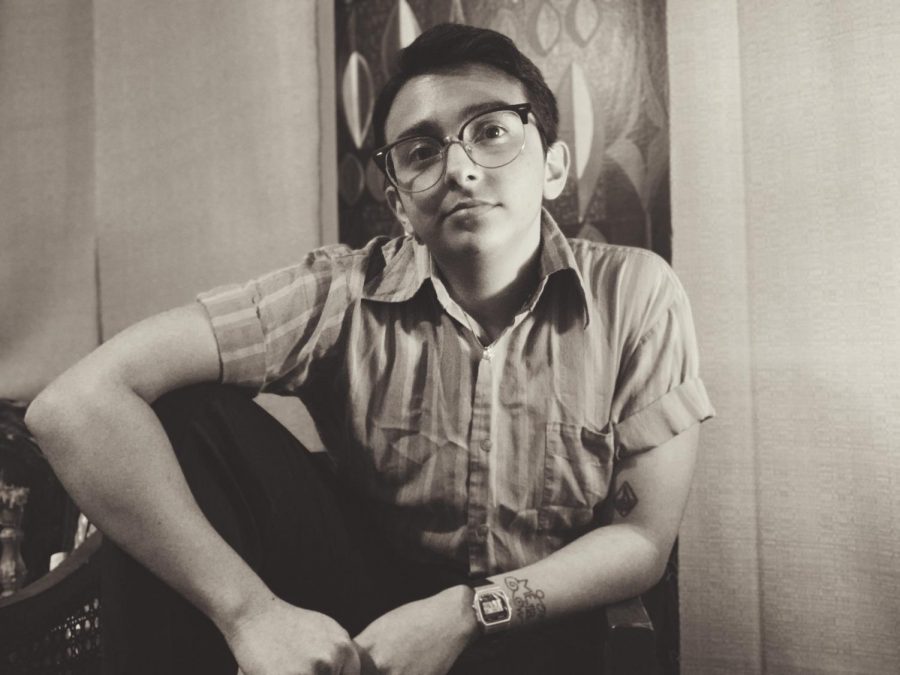

Freshman physiology major, Anthony Hernandez, is amazed that investors as young as himself profited off of gamestop, however, he admits that the scene seems quite intimidating.

“I wanna start making money and these guys make it look so easy, but after reading a single article, I have no idea what anything means or where to start,” said Hernandez.

Hedge fund, short squeeze, and volatility created a complicated jargon for students without financial context. Although these are simple terms for anyone on Wall Street, diving head first into the market may feel overwhelming.

Despite the initial confusion, Liam Smith, a senior political science major and minor in economics, reassures students that investment is quite simple.

“The stock market is a market where publicly traded companies sell something called common stock to the public, i.e. a share of the company,” said Smith over Zoom. “You use dollars to buy certain shares you think are going up.”

The basic premise of stock is: buy because you expect it’s value to increase. Smith claimed there are two ways to project this: speculative trading and fundamentals.

“Whenever you buy stock, its value increases because there is more of a demand for it. This is called speculative trading, paying for a share because you speculate that it will go up,” said Smith. “For fundamentals in investment, it’s comparing the performance and earnings of a company and evaluating the worth of its stock.”

With money to be made, the stock market is an enticing opportunity for students to generate passive income.

Because Hernandez is busy with classes, he wants to increase his savings without the dedication of a full time job.

“The stock market seems perfect for students like me during COVID because we have school to take care of and working at a store might jeopardize our health. I know it’s not the same as a job but at least I don’t have to dedicate hours of work,” said Hernandez.

Smith expands on this idea by highlighting the importance of passive income.

“I would encourage every student to invest in the stock market because it’s another source of income that you don’t work for. If you want to retire early and not work extra hours, it’s a great way to make money because the stock market will always go up,” said Smith. “There are always new companies and new opportunities to buy and sell.”

Because apps such as Robinhood, Ameritrade, and Fidelity exist, the stock market is now truly accessible to the average person.

“The problem is a lot of people don’t trust the stock market. They think that the stock market is only reserved for people on Wall Street and that’s just not true. They’re publicly traded companies,” said Smith.

Knowing the benefits of investing into the stock market, there are also risks that need to be assessed.

For instance, depending on when someone purchased GameStop stock, there was potential to make millions, but also potential to lose every ounce of investment. To participate securely in the market, it involves thinking long term over short term.

Hernadez considered buying Gamestop, but was glad he hesitated because the price has depreciated significantly.

“It’s so anxious watching the price go up and down. When Robinhood made the stock unpurchaseable and the price dipped, it really scared me out of it. But if I even bought it for $100, it’s only like $60 now. I would’ve wasted my money,” said Hernandez.

With such risks, it is important to note that there is a significant line between investment and gambling.

Through practices such as buying options or day trading, there are high risk/high reward potentials for the stock market. Despite the incentive to make a quick buck, consistent gain on personal capital happens over time.

“95% of my portfolio is invested in long term growth stocks,” said Smith. “Apple isn’t going anywhere anytime soon. People only want more iphones; people only want more Teslas; these companies aren’t going anywhere and the earlier you get in the earlier you’ll make money.”

With work, school and personal life to consider, trading stocks for the long haul is an easier way to balance life and treat assets as passive income, not immediate cash-out.

“There’s an information gap. [People] are never taught [long term growth]; they don’t understand it and that’s what’s hurting the mindset of long term growth,” said Smith. “If you want to invest in the stock market, you won’t be a millionaire overnight; you’re gonna be a millionaire in 30 years.”

With three simple steps, Smith says that students can start investing in their future almost immediately. Get a brokerage account, download Robinhood, and take advantage of online resources for financial advice.

“After you get free information and get a brokerage account, throw in a hundred dollars and see where that gets you,” said Smith. “The stock market is great because when it’s up it benefits everyone. The only thing an investor wants is to see their investments grow.”

Moe Lester • Feb 18, 2021 at 3:14 am

If you actually want to make money from the stock market, you HAVE to put hours into it. Don’t make it seem like “hey I throw my money into blue chip stocks and become a millionare….in 45yrs.” Learn to value invest kid. Apple is a good investment long term, yes. But Tesla, not so much. They are INSANELY overvalued. You don’t even have to look at their financials to see how overvalued they are, I mean just look at their EP ratio, its over 1,000!!!!!! Tesla is 8x time over fair value. Long story short, (this is directed to readers) do not take advice from a person who trades on robinhood and on top of that had gamestop stock and on top of that panic sold.

Liam Smith • Feb 12, 2021 at 2:40 pm

Great article Micah! I hope students will see how much potential there is to grow your money through the stock market!