Seattle passes law that some see as regressive, counterintuitive towards its goals

On New Year’s Day, a new tax went into effect throughout the city of Seattle. The new measure, dubbed the “soda tax,” increased the price of soda and other “sugary drinks,” such as Gatorade, bought within city limits by 1.75 cents per ounce.

The tax was passed in June with the intention of discouraging people from buying sugary drinks, which have been linked to serious medical conditions including Type II diabetes, heart disease and hypertension.

Additionally, a portion of the revenue collected from the soda tax will go to a local nutrition program called “Fresh Bucks” that provides low income families with vouchers to buy fresh produce for their children.

The objective of the tax, to motivate people to live healthier lifestyles, is full of good intentions.

However, it is not just intentions that matter, but execution as well.

Seattle is not the first to make this move, as soda taxes have been implemented in other cities across the nation over the past two years, with varying degrees of success.

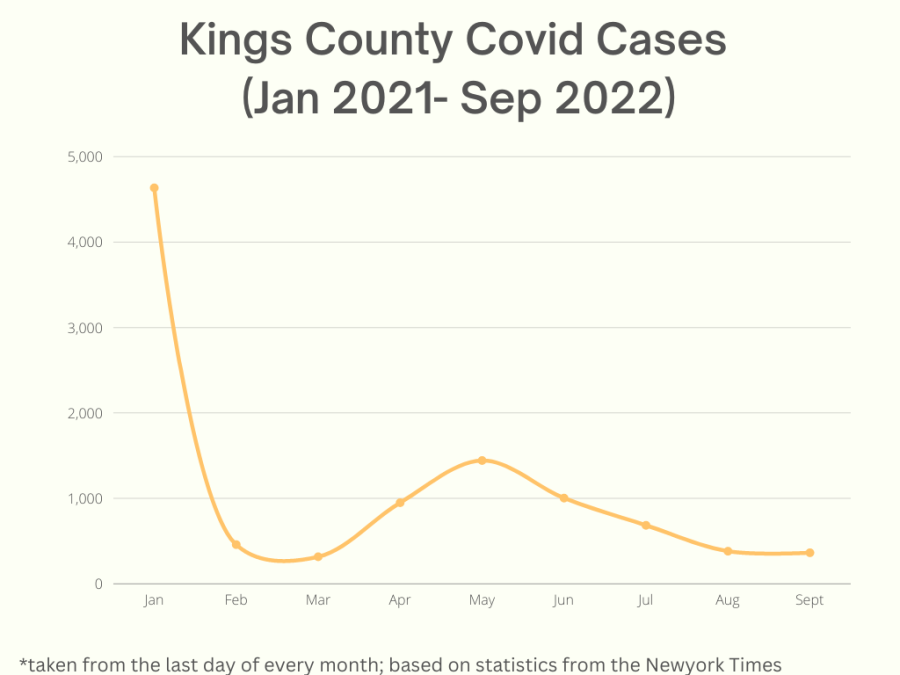

In 2015 Berkeley, California imposed a soda tax at 1 cent per ounce (75 percent less than Seattle’s) and saw a 21 percent reduction in overall soda consumption. However, Philadelphia imposed a 1.5 cent per ounce tax in January of 2017, and saw sales reduced by up to 50 percent, causing layoffs by both manufacturers and retailers.

There are several concerns over the possible long-term effects of the soda tax.

First, preliminary statistics from other cities suggest that a higher tax per ounce corresponds to an increase in negative consequences, and Seattle has the second highest rate in the nation.

Secondly, there is also the concern over what kind of precedent is being set by imposing these taxes.

Encouraging people to make healthier choices is unequivocally positive, but there is a difference between encouraging and forcing.

Local South Lake Union physician Dr. Mary Anne Bauman was quoted by the Seattle Times as saying that “Most people are getting way more sugar than they need … We have an obesity epidemic, and taxes are a way to change behavior. That’s the goal.”

However, Bauman’s view of taxes as a means of control perfectly undermines the original and right justification of taxation.

The purpose of taxes is to provide necessary funds so that the government may serve the needs of the people, and it exists for this purpose only. Taxation is not a medium of control.

Allowing it to become one sets us on a dangerous path of unchecked government power.

If legislative bodies want to motivate people to make healthy choices, should they tax our data consumption as a way to limit the time Americans spend in front of screens? Should there be a tax on people who live intentionally unhealthy lifestyles and thereby overburden Medicare and Medicaid programs?

Most people would object to all of these suggestions as ludicrous invasions of personal privacy.

The same principle applies to the soda tax, which could be a precursor to these next, more extreme, measures.

I would rather see our city focus on enabling citizens to make their own informed choices as opposed to trying to limit them.

The citizens of Seattle ought to take inspiration from Cook County, Illinois, where a voter referendum took place last November.

Citizens voted to repeal the soda tax and demanded that their leaders use the funds already collected from other taxes to accomplish their goals, rather than simply taking more.

The soda tax has the potential to wreak dangerous consequences for local small businesses, and may cause some to lose their jobs. Unionized workers have come out against the tax as “regressive,” according to the Seattle Times.

Listening to the concerns of labor union and business communities would be prudent on the part of Mayor Durkan.

A repeal of the tax in favor of focusing on educational efforts would ultimately promote longer lasting change, as people can decide to change their mindsets and habits for themselves.

“Consumers are more receptive to a sales pitch than to a punitive tax,” the Chicago Tribune said in a recent article.

If the government wants to create a healthier culture, they ought to focus on giving people the right resources to make informed choices, rather than assuming they cannot be informed and attempting to force citizens to conform.

Our democracy is based on personal liberties; the government operates on an assumption of service.

Allowing legislative bodies to overstep their bounds puts individuals at risk, as it allows for the possibility of a snowball effect to take place.

In other words, not all great ideas make great laws.

When considering new measures, one should always consider the ripple effects rather than just the singular problem that needs to be fixed.

Health issues need to be addressed in our city, and indeed our country, but we need to do so in a way that respects the bounds between the power and the people, and will therefore be sustainable.