Cryptocurrencies have been on the rise for more than a decade now, however, the huge rise in crypto’s popularity, such as Bitcoin, has revealed huge cracks in its core. Extreme price volatility, lack of regulation and ethical concerns that leave investors vulnerable have all gone hand and hand with the rise of crypto. To address these challenges, regulators, financial advisors, auditors and investors must prioritize standardized accounting practices and enhanced financial literacy to protect investors and stabilize the market.

Unlike traditional currencies, which are backed by tangible assets like gold or government guarantees, cryptocurrencies lack intrinsic value.

As Han Ziling notes in The Analysis of Bitcoin’s Price Fluctuation, a study released by Ulster University, when comparing crypto to the U.S. banking system.

“For virtual currency, it is impossible to effectively suppress inflation in the virtual world due to the lack of sufficient gold.”

Instead, cryptocurrency prices are driven largely by investors’ enthusiasm, making them highly speculative.

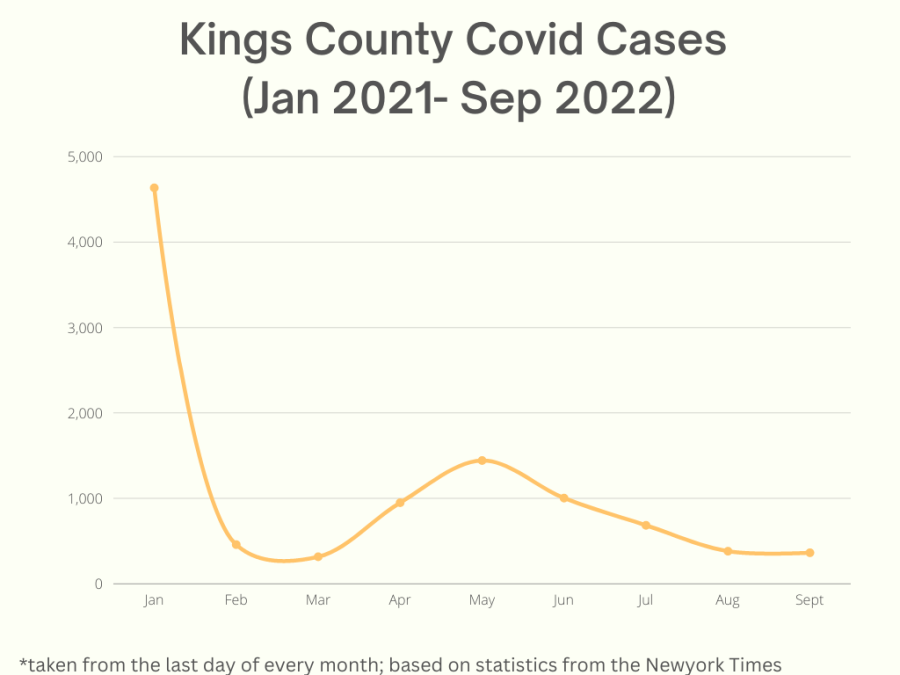

Bitcoin’s price fluctuations exemplify this volatility: its value skyrocketed 4,638 times from 2013 to 2021 but has also experienced dramatic crashes, including drops as high as 50% within days following regulatory news or market sentiment shifts. This is characteristic of a wildly fluctuating market for an unstable investment product, a market that is prone to react strongly to shifts in demand.

Currently, regulation of cryptocurrency is almost nonexistent. In Washington state, the only requirement is that businesses involved in buying or selling cryptocurrency must register as money transmitters — with the exception of businesses with “storage purposes”— but, contrary to the public registration system that exists for the trading of stocks and bonds, private individuals face no such requirement to register. This lack of oversight creates a “Wild West” environment where fraud and manipulation thrive.

Because of its volatility cryptocurrency has been easily manipulated to use for unethical investment practices that take advantage of unaware investors. One notable case is internet celebrity Hailey Welch’s cryptocurrency, “$HAWK”. Promoted as a community token for her fans, only 3% of the coin was made available to the public, while Welch and her team retained 17%, and left 80% undistributed. The coin quickly rose to $500 million in value after its release to the public, but 20 minutes later, its value dropped to just $3 million after half of the insiders sold off their holdings, decimating the coin’s value by 95%. Welch’s team reportedly profited $2 million in fees alone.

Advocates argue that the basis of cryptocurrency, blockchain technology, offers new age technological benefits. The Blockchain creates a digital ledger where transactions are secure, transparent, and immutable.This technology could transform industries beyond finance by improving transparency and efficiency. Others claim that Bitcoin’s capped supply (21 million coins) makes it a hedge against inflation, akin to digital gold. By limiting supply, proponents argue that Bitcoin can retain its value, even as other cryptocurrencies lose purchasing power.

However, these arguments fail to address the fundamental risks to investors that come with using crypto as an investment vehicle. Blockchain technology does nothing to mitigate cryptocurrency’s price volatility due to its lack of intrinsic value, and the cryptocurrency market lacks the guardrails to prevent fraud and abuse that exist in other, more traditional investment markets. Similarly, the speculative nature of many Bitcoin investors contradicts its reliability as an inflation bet; sudden sell-offs or regulatory changes can erode its value overnight as seen with Welch. Furthermore, 1.86% of investors of Bitcoin hold more than 90% of its total supply. This distribution of assets is eerily similar to Welch’s $HAWK.

To mitigate the prevalence of scams, weak regulators and investors alike should commit to improving financial literacy, specifically education on the risks of cryptocurrency investment, and the mechanisms and limitations of blockchain technology. Further resources should be provided to all investors. Future accounting should be able to include crypto as an asset on the balance sheets and evaluate it accordingly, and should standardize uniform tax reporting practices for cryptocurrency transactions.

If cryptocurrency is to remain a prominent investment market, the extreme price volatility, lack of regulation and oversight and prevalence of fraud and abuse in the market demand urgent action. Absent guardrails and education to protect investors, the lack of intrinsic value that makes cryptocurrency appealing to some may be its downfall in investment markets.

Financial advisors and investment professionals would be wise to educate potential investors about the risks of investing heavily in cryptocurrency, and regulators must consider implementing standardized accounting practices to bring guardrails and oversight to this growing investment market, or else the market’s Wild West nature may be its downfall.