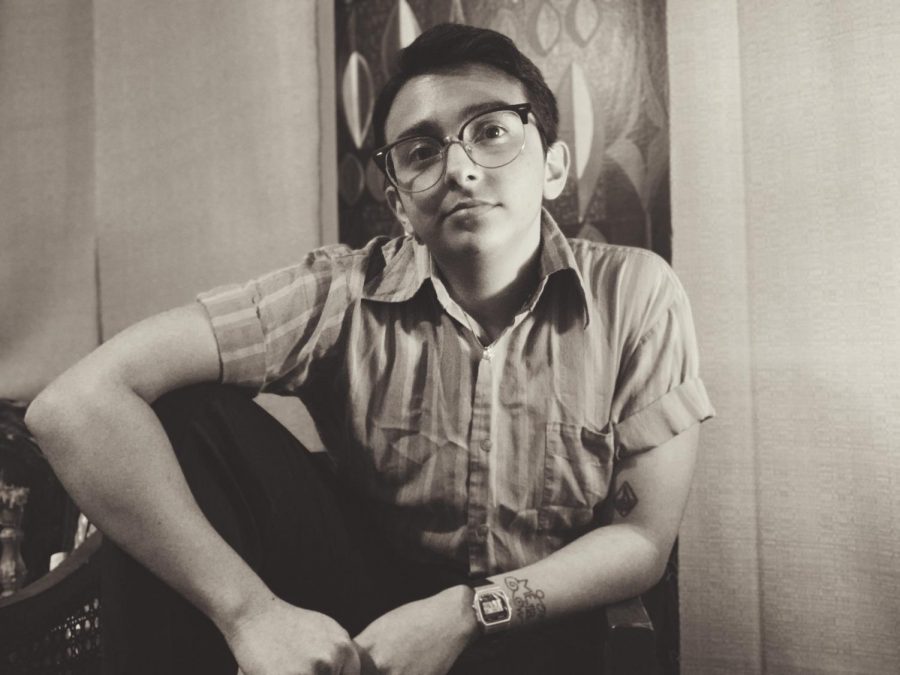

April 15, 2024 was Tax Day. While some scrambled to find their W-2 pdfs and parents’ middle names, Zachariah Nacke enjoyed the day peacefully — his taxes had been filed for three months.

A senior history major in the school of education at Seattle Pacific University, Nacke is in his sixth year of filing taxes. Taxes can be intimidating for first-time workers or rosy-cheeked freshmen, but not Nacke.

“It’s pretty chill and easy, honestly. I usually have a half hour, and I sit down and turn on some music to crank through it,” Nacke said.

“Cranking through it” entails gathering documents and personal information, then filing online or over mail.

The most important form to have while filing taxes is the W-2 form, which tells employees their total income for the year. Employers send paper or electronic forms to filers in January — for SPU student workers like Nacke, they can be found on Banner under the Employee Menu.

Nacke was a student employee for most of his SPU career. From two weeks at Gwinn, to a year as an RA, then one in the mailroom, Nacke’s income and tax forms during his four years were accessed through SPU’s online portal, Banner.

“I liked the opportunity to work while I’m a student,” Nacke said. “SPU makes it really easy with taxes, so it’s quick.”

Federal income taxes are often withheld from paychecks before they hit the bank account. Also included in the W-2 is the amount of taxes withheld, or already paid.

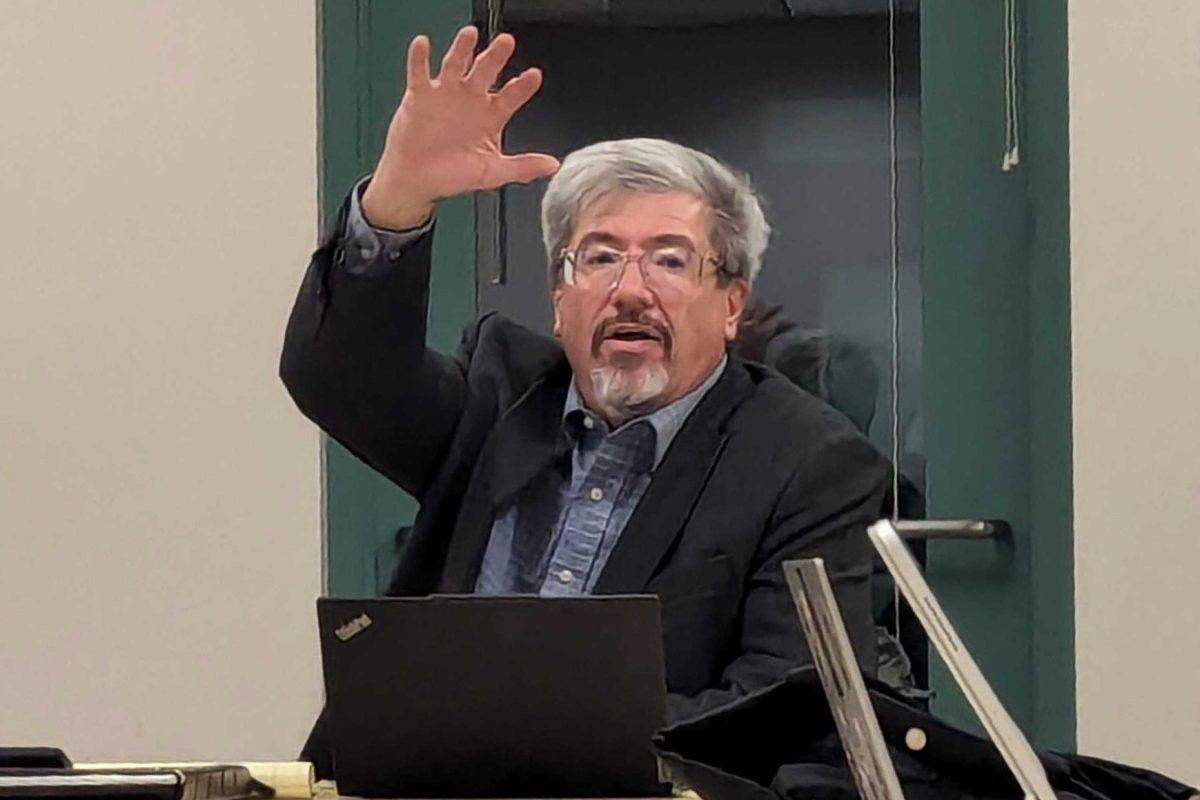

“You’ve been paying taxes all year, so that’s why it is important that we get that paycheck stub,” said Professor Emeritus of Economics Douglas Downing.

Based on income and other factors, taxpayers owe the federal government a certain amount at the end of the year. The point of filing taxes is to gauge whether the taxes already withheld from employees’ paychecks are equal, less than or more than that owed amount.

If the amount of taxes paid does not equal the amount of taxes owed, the filer must pay the Internal Revenue Service the difference. If the amount paid exceeds the amount owed, filers get a tax refund.

“Your goal is to end up breaking even,” Downing said. “By that, I mean you neither owe a chunk of money nor get a big refund. If you get a big refund, you’ve been overpaying your taxes during the year. The goal then would be to adjust the withholding amount.”

Nacke came out winning — he got a direct deposit refund of around $100, which went toward gas and DoorDash.

Because most students do not have children, multiple incomes or joint-filing complications, taxes can be a breeze. The growing use of online tax filing programs like TurboTax and TaxAct — Nacke’s choice — streamlines the process as well.

“It saves all your information, so pretty much all I have to do is upload my W-2 form,” Nacke said.

The IRS is a resource for confused filers, with expanded taxpayer service in 2024. An IRS news release published on April 15 (Tax Day) outlined the increased services available.

“Compared to a year ago, the IRS answered over 1 million more taxpayer phone calls this tax season, helped over 170,000 more people in-person and saw 75 million more IRS.gov visits fueled by a new and expanded Where’s My Refund? tool,” reads the release.

Also included in the W-2 form is the amount of money taken from each paycheck for the Social Security program for retirement.

“Social security basically runs its own tax system,” Downing said. “There’s no April 15 filing for that, they’re just taken out of every paycheck.”

Downing encourages students to start thinking about Social Security and other retirement plans. As the average life expectancy increases, the system struggles to keep up. Downing described how Social Security is gradually raising Social Security taxes and pushing back the retirement age.

Benefits from Social Security are available at age 62, but more plentiful if accessed only at the official age. For those like Downing — born in 1957 — that means being 66 years and 6 months old. Downing reached full retirement age recently, in April 2024.

After teaching full time at SPU for 35 years, he decided to teach part time rather than retire fully in 2018. He teaches four to five classes a year, including various economics and astronomy classes.

“One of the reasons I do what I do is that I think we need gradual retirements,” Downing said. “I don’t know that it’s the best thing for somebody just to work 100% one day, then 0% the next.”

64-year-olds and younger in 2024 face an official retirement age of 67, likely to increase in future years.

Downing recommends students begin thinking early about retirement plans — investing, saving and planning is crucial.