Downturn or recovery

Staff, students discuss their thoughts about the current and future state of the economy

September 28, 2022

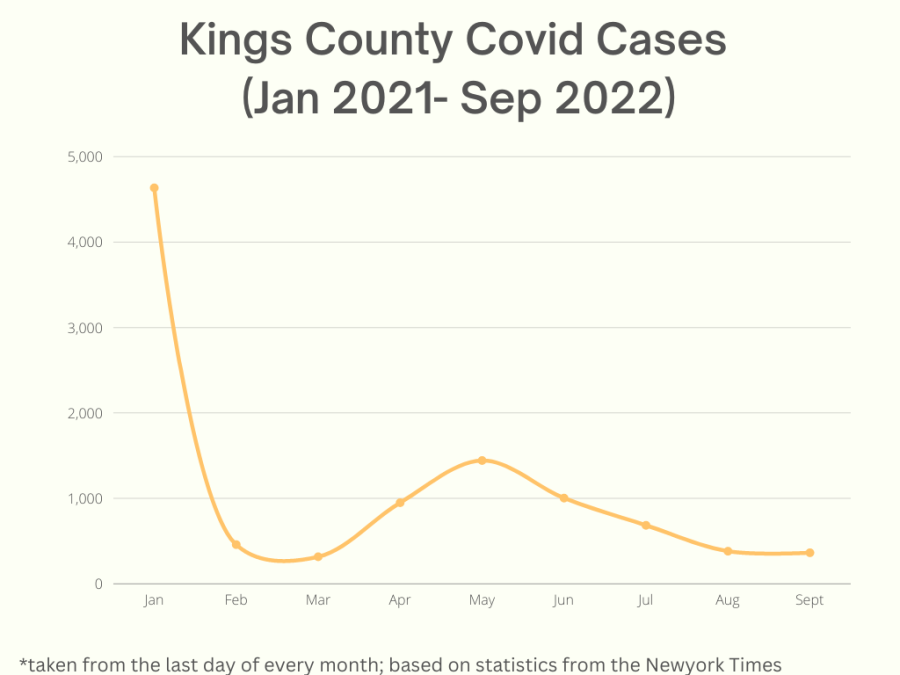

Throughout the COVID-19 pandemic, businesses and families have struggled, and, while many parts of the economy have reopened, some students are still feeling the effects of the shutdown and the latest economic struggles. Some faculty and students at Seattle Pacific University are concerned about the continued effects of inflation on the higher education system.

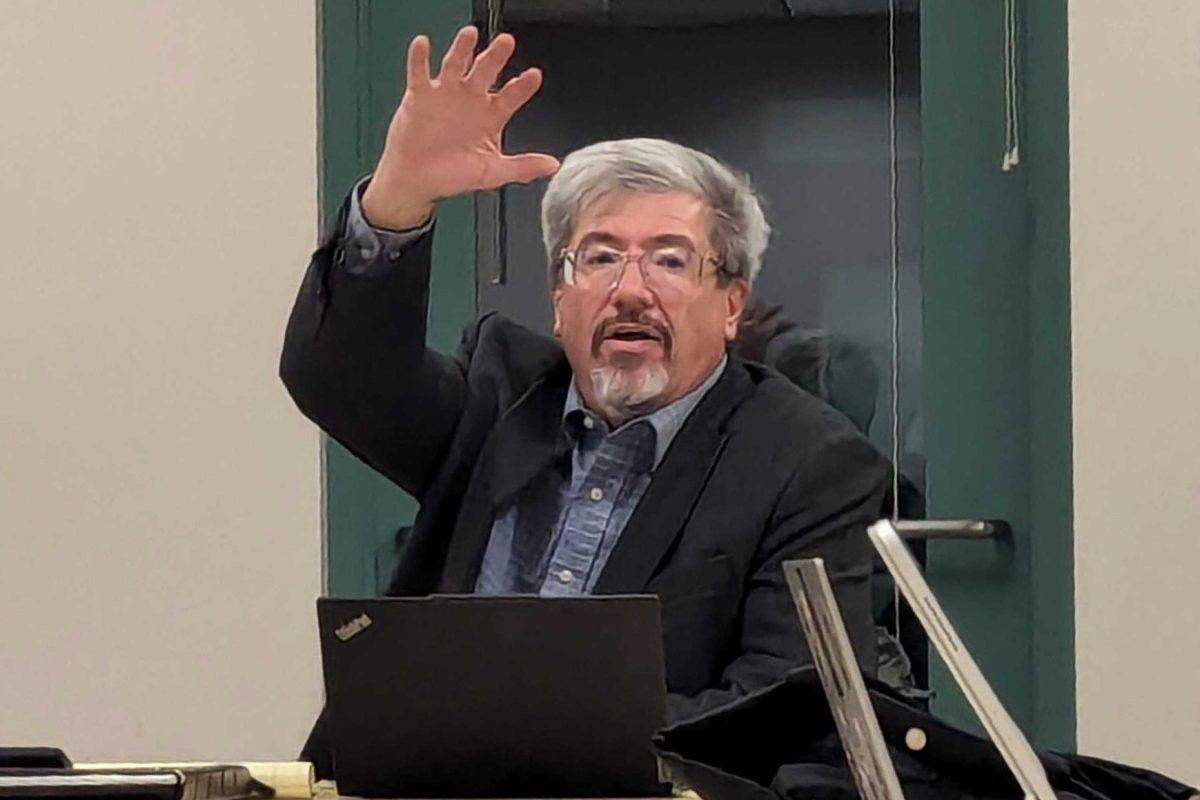

Professor of economics Douglas Downing is concerned over the potential effects of the current economy.

“One of the biggest issues we’re looking at right now is inflation. We don’t know what the consequences of the policies related to [inflation],” Downing explained. “This came at a serious cost, which was an unemployment of 10%. We don’t want that.”

Downing also expressed concern about the economy moving forward.

“The big problem is the uncertainty about the future, because it’s hard to adapt to uncertain inflation. We don’t know if it will settle down again or keep going,” Downing said. “This is a big reason why economists can’t forecast the economy. There are so many factors at play that you can’t account for them all.”

For second year electrical engineering major Matthew Spickelmier, being a student means that these economic cycles can have lasting effects.

“I feel like it’s gonna come up because it always fluctuates and cycles, right? But I feel like definitely, there are folks who will be impacted,” Spickelmier said. “This is a really transitional point in our lives, and so, if the recession puts you in a disadvantageous position, then that’s going to have lasting repercussions.”

Third year business information major Ben Yamio has experienced the inflation in a more tangible way because he is an international student.

“The current inflation is tricky,” Yaimo said. “As an international student, the rise in prices has made living expensive.”

In the spring of 2021, SPU committed to a 25% drop in tuition called Tuition Reimagined. At the same time, they committed to no more than a 4% annual increase. This is compared to other higher education institutions in the area such as Seattle U increasing by 3.75% and University of Washington increasing by 2.3%.

Downing expressed concern over the rising price of higher education for students and the costs and benefits of the higher education system.

“For many years, college tuitions have been going up faster than the inflation rate. Colleges have been trying to make sure that there’s enough financial aid to keep things affordable,” Downing said. “There’s still this huge value you get with education, which still rewards the kinds of jobs you can get. Even with these huge rewards, it’s still a finite benefit, so it’ll have to even out eventually.”

Downing also pinpointed potential issues for students.

“For students, there’s a couple issues to point out,” Downing said. “When people are expecting inflation, that’ll be driving interest rates up, and, for students, this might drive loan rates up.”

Spickelmier also shared his thoughts on how the recent debt forgiveness has benefited students and might help combat inflation in the long run.

“The one economic thing that I am aware of that I know has impacted students was the debt forgiveness that occurred,” Spickelmier said. “This is just such a period where if you don’t get off on the right foot, then it’s gonna mess you up. Or it can be a lot harder to climb back.”

Yet, for multiple reasons, Spickelmier sees fewer visible impacts for SPU students and doesn’t feel the inflation quite as much at school.

“I was just talking with someone about this, but I don’t have a car right now. So I don’t feel the gas prices. I felt them when I was over for the summer at my house, and I was driving a car but on campus, I don’t feel it,” Spickelmier said. “I feel like it’s one of the more visible signs of inflation for folks our age.”