Pandemic pause for students

Federal student loan aid to end in spring

April 6, 2022

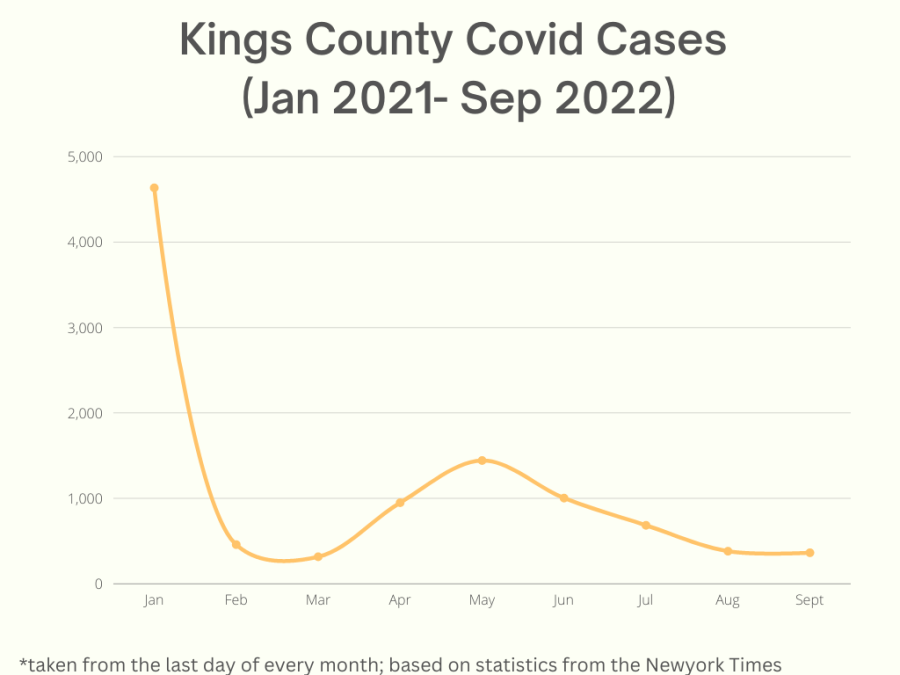

The student loan payment pause has supported many students during the pandemic’s hardship. While the pause has been extended until August, the possibility of losing that financial support has reminded students of the reality of loans and the cost of their tuition.

On Dec. 22, 2021, the U.S. Department of Education extended the student loan payment pause through May 1, 2022. The pause protects relief measures such as a suspension of loan payments with a 0% interest rate and stopped collections on defaulted loans. On April 5, the pause was once again extended through Aug. 31.

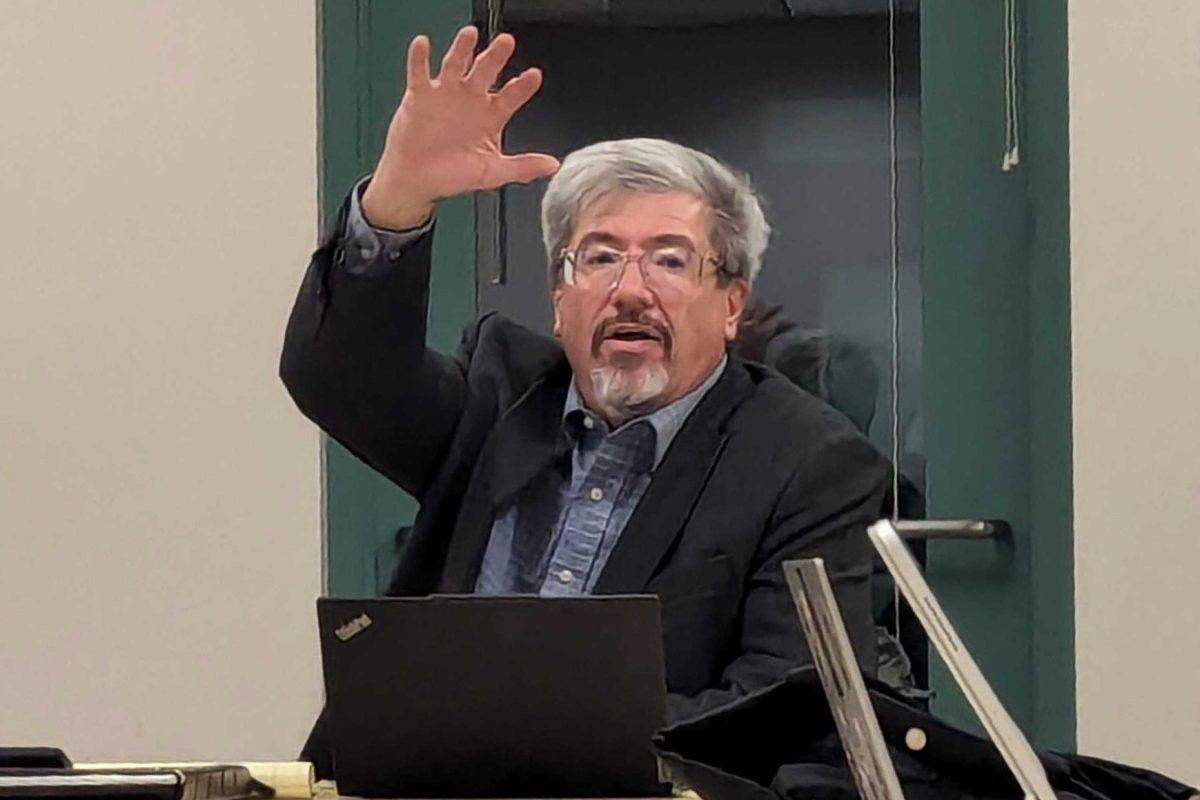

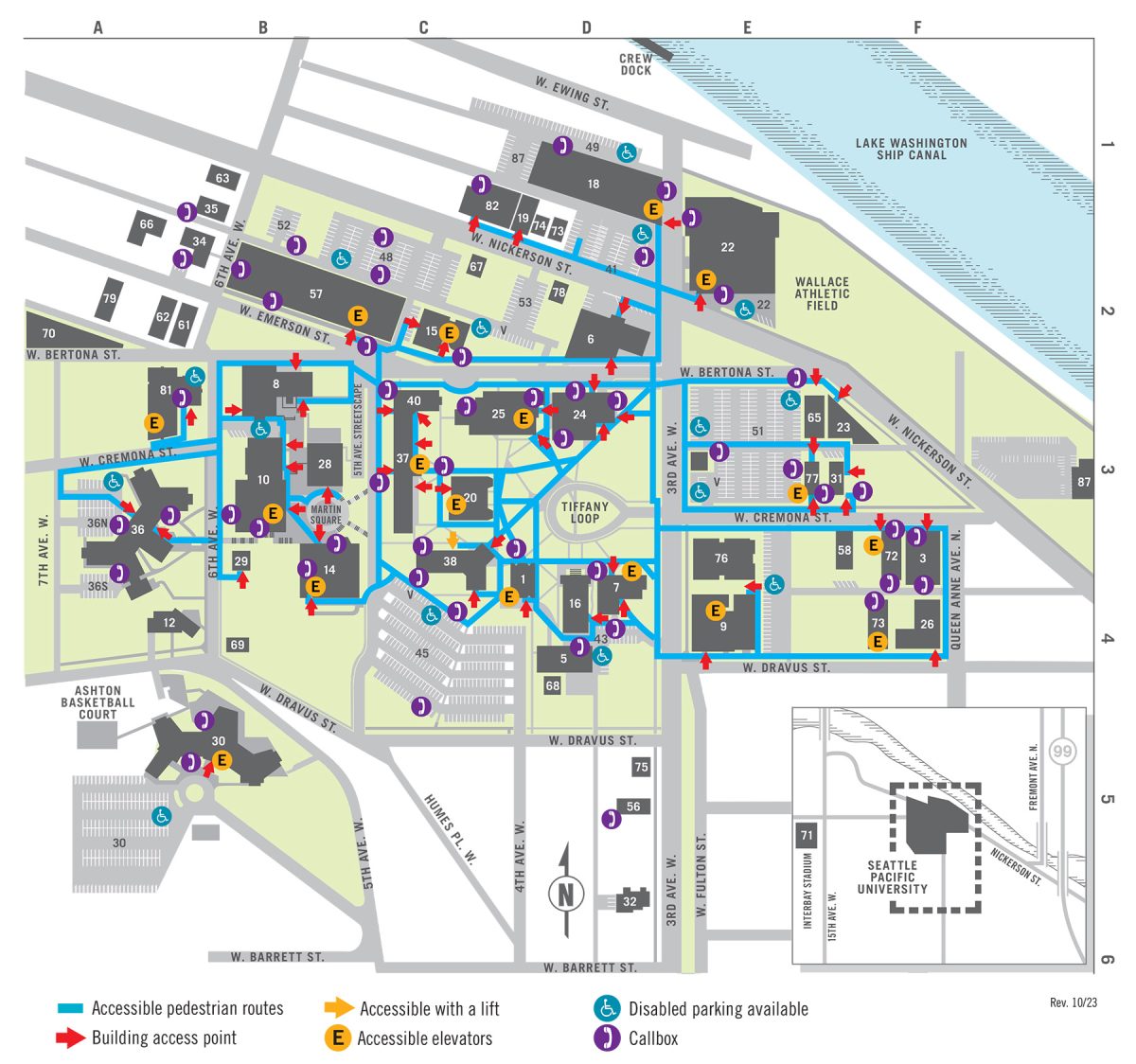

According to Ben Lockyear, the assistant director for student financial aid and loans at Seattle Pacific University, the 0% interest rate provides students financial support to deal with the pandemic.

“The biggest advantage is that students are free from interest rates because of the pause,” Lockyear said. “No concurrent interest is a significant benefit for many students, especially those with subsidized loans and graduate students who have federal loans.

In response to the May 1 deadline, before the extension was announced, Lockyear shared that there may be another delay on the student loan pause. If not, there will be no significant impact on current students.

“There’s the possibility that they would delay it further. I don’t think there will be any immediate impacts on current students at SPU,” Lockyear said. “Students who are still in school don’t have to make payments or anything until they graduate. But they will notice the interest that goes with the loan, so I recommend that students look at their loan value and keep an eye for those kinds of information because it is important to be ahead on this.”

With the stress caused by the possibility of the end of the pause, many were reminded of the benefits of the pause and what will happen when it ends. Hanna Roseen, an SPU alumni who graduated in 2018 with a bachelor’s in gender studies, shared how the pause impacted her.

“I finished grad school in June 2020,” Roseen said. “It took me a while to find a job in my profession — librarianship — and then I had to move across the state. I was able to manage all my expenses better because of the freeze.”

Even though Roseen is no longer in school, the continuation of the freeze will be beneficial.

“A continued freeze would give me more flexibility, a safety cushion, and the ability to create a warm and welcoming home in a new place if I move,” Roseen said.

Senior and psychological science major, Angela Shadle, has also found the freeze helpful in getting through her education.

“In the past, the freeze helped me by ensuring that my student loan costs stay down and interest doesn’t build on my student loans,” Shadle said. “Especially when I need to take a quarter off as a disabled student, having the interest freeze is really helpful in keeping my costs reasonable.”

Like Roseen, Rebekah Johansen is an SPU alumni, who graduated in 2018. Johansen now works at SPU’s Financial Affairs as a budget & financial analyst. She managed to pay off her undergraduate loan and go to graduate school during the student loan pause.

“Interest has not built-up for the last two years for students, so they won’t have that put on top of what they will pay when they’re out of school,” Johansen emphasized.

As a budget & financial analyst, Johansen acknowledged student loans as an opportunity to learn about financing. She believes it is an essential lesson for college students about budgeting.

“It’s important to know where your priority lies, to know where the money comes from and how it can be spent,” Johansen said. “It is about learning to budget and make sure there’s a stretch of balance between doing what you love and what helps pay the bills.”